In 2025, the government plans to intensify efforts to exceed fiscal and budgetary targets by increasing revenues and reducing expenditures, focusing on investment in critical infrastructure projects, said Deputy Prime Minister Ho Duc Phoc

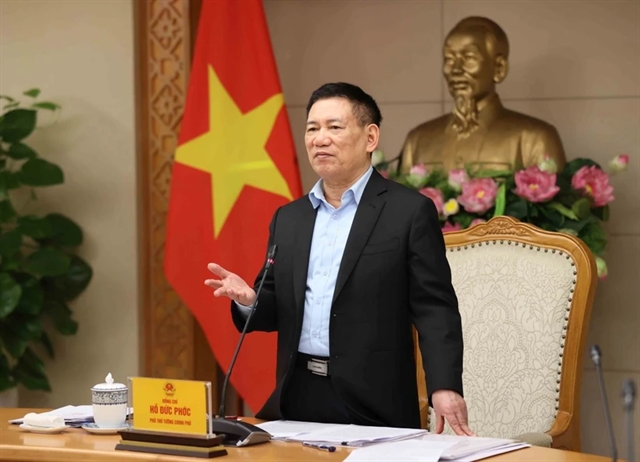

Deputy Prime Minister Hồ Đức Phớc. VNA/VNS Photo

In 2025, the government plans to intensify efforts to exceed fiscal and budgetary targets by increasing revenues and reducing expenditures, focusing on investment in critical infrastructure projects.

That was the message from Deputy Prime Minister Hồ Đức Phớc in an interview with the Vietnam News Agency to discuss key milestones in 2024 and the government's plans for this year.

2024 presented a lot of challenges for Vietnam’s economy. Could you share your assessment of the results achieved in State fiscal and budgetary tasks last year?

2024 was a challenging year for Việt Nam. Externally, we navigated tax policies, interest rates, exchange rates, inflation, and military conflicts. Internally, as a highly open economy, we faced additional hurdles like climate change, flood damage, low productivity, limited technological capabilities and a shortage of high-quality human resources. All this occurred alongside the pressing need for rapid growth and substantial capital.

Despite these challenges, we made notable success in our socio-economic development goals. For instance, GDP growth is projected at 7 per cent, surpassing the National Assembly’s target of 6–6.5 per cent. Inflation has been kept at 3.88 per cent, below the 4 per cent target. Public debt is comfortably below the limit set by the National Assembly. Additionally, foreign trade reached a record US$800 billion, exceeding 2022’s figure of $732 billion.

State budget revenues also performed exceptionally well. As of 24 December, revenues stood at VNĐ1,978 trillion, exceeding forecasts by about 15 per cent and surpassing the previous year by 17 per cent. By year-end, we expect revenues to surpass projections by over VNĐ300 trillion compared to 2023. These achievements reflect effective fiscal management, which has supported investments in infrastructure projects like the North-South expressway and social welfare policies.

Given the rising challenges in securing State budget revenues, how does the Government plan to tackle spending in 2025?

Our approach to fiscal management focuses on increasing revenues and ensuring efficient spending. To support businesses, we’ve implemented tax deferrals, fee reductions, and land rent discounts, amounting to about VNĐ200 trillion annually. Meanwhile, public spending is carefully managed across investment and recurrent expenditures.

The Prime Minister has issued clear directives for 2025. First, we’ll reduce recurrent expenditures by 10 per cent from the initial budget allocation. Second, 5 per cent of recurrent spending will be redirected to eliminate substandard housing for the poor. This initiative will mobilise around VNĐ7 trillion from savings (excluding salaries and allowances) to support this cause.

In terms of infrastructure investment, public funds will prioritise high-impact projects to drive economic growth. We aim to complete 3,000km of expressways this year, and expand to 5,000km by 2030, alongside advancing high-speed rail projects. To maximise efficiency, we’ll ensure strict oversight of bidding, contractor selection, and project supervision.

Public investment is often highlighted as a key driver of socio-economic development. What measures will the Government take to accelerate the disbursement of these funds?

Public investment is indeed a vital growth engine. However, procedural obstacles like project planning, design appraisals, and land clearance often delay disbursement. To address this, we’ve proposed amendments to the Law on Public Investment and related laws, allowing issues like compensation and land clearance to be approved as separate plans. This adjustment should help us reduce construction delays considerably.

Additionally, decentralisation will empower ministries and localities to expedite administrative procedures and approvals. As of November 2024, public investment disbursement had reached 56.4 per cent, with a significant surge expected in the final months. For 2025, prioritising early disbursement will be critical to sustaining economic momentum.

What are your key priorities for ensuring the successful execution of State fiscal and budgetary tasks this year?

The 2025 State budget revenue target is VNĐ1,978 trillion, with most sourced domestically and some from foreign trade and crude oil. Budget expenditures are projected at VNĐ2,500 trillion, with a 3.8 per cent budget deficit relative to GDP.

To achieve these goals, we’ll focus on increasing revenues, cutting expenditures, and reducing the budget deficit. Measures include extending VAT and environmental tax reductions on fuel for the first half of 2025 and managing new revenue streams like e-commerce and cross-border transactions. At the same time, spending will be targeted and efficient, with savings redirected toward social welfare and infrastructure development.

Regarding the coming merger of the Ministry of Finance and the Ministry of Planning and Investment, what are the anticipated benefits?

This merger is a strategic step aligning with development trends. It will streamline operations, reduce payrolls and cut recurrent expenditures, which currently account for 68 per cent of total budget spending.

The General Department of Taxation, for instance, will change to the Việt Nam Tax Department, and reduce 63 branches to a maximum of 35. Similarly, the General Department of Customs will scale down from 35 to 15 regional offices, with an overall 40 per cent reduction in personnel. VNS

Read original article here