Numerous issuing organisations, notably those in the real estate sector, have sought debt restructuring for both principal and bond interest payments.

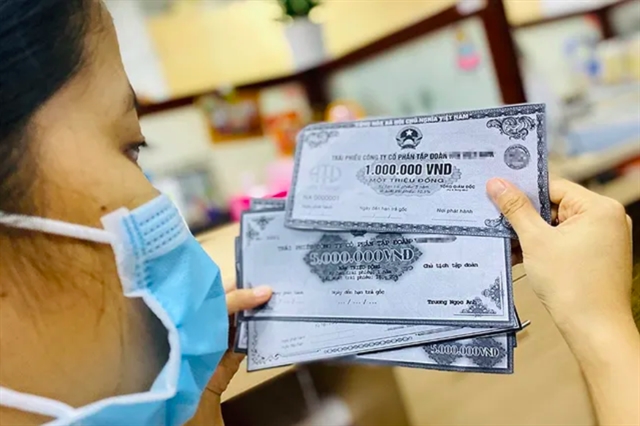

Concerns persist over corporate bond issuers meeting repayment obligations. — Photo PLO

Bond default risks are inevitable across markets and investors must exercise responsibility and thorough understanding before embarking on investment decisions, said experts.

Recently, numerous issuing organisations, notably those in the real estate sector, have sought debt restructuring for both principal and bond interest payments, according to the Hà Nội Stock Exchange (HNX).

For example, on August 13, Fuji Nutri Food JSC announced a delay in settling the VNĐ998 billion (US$40 million) principal for bond code FNFCH2223001 (due for payment on August 21), citing challenges in organising funds for payment.

Last September, the company also reported a postponement in paying the VNĐ20.87 billion interest on bond FNFCH2124001, which was due to a similar reason.

Another entity, Big Gain Investment Limited Company, faced payment delays for bonds BGICH2124001 (VNĐ8.9 billion interest and VNĐ78.4 billion principal) and BGICH2124002 (VNĐ49.7 billion interest and over VNĐ438 billion principal).

Big Gain is currently engaged in negotiations with investors regarding the repayment schedule for both principal and interest.

Other cases of delayed bond repayments have been reported, involving companies like Novaland and Gia Đức Real Estate Company.

Experts forecast that this would be a trend.

VIS Ratings estimated that around 27 per cent of maturing bonds are at risk of late repayment, including 65 per cent with previous delays. The pressure on corporate bond maturity remains high for 2024 - 2025.

Decree 08/2023/NĐ-CP on private placement of corporate bonds has expired, but two key amendments persist, allowing companies to extend bond terms by up to two years and repay in assets other than Vietnamese currency with bondholder approval.

Despite extending bond terms by two years, concerns persist over corporate bond issuers meeting repayment obligations.

Experts worry about market impacts due to potential defaults, with bankruptcy seen as a fundamental remedy.

Dr Lê Xuân Nghĩa, an economist, advocated for bankruptcy in cases of non-payment, urging investors to accept risks.

Similarly, Đỗ Ngoạc Quỳnh, General Secretary of Việt Nam Bond Market Association (VBMA), stressed enhancing the Bankruptcy Law for market stability, highlighting the need for effective debt resolution to prevent systemic issues.

Quỳnh refers to cases globally where insolvent companies must publicly disclose their status, convene creditor meetings or hire independent assessors to determine whether to seek bankruptcy protection or file for bankruptcy.

Although negotiation mechanisms exist, few retail investors can effectively assess bonds. Consequently, they may panic as bond maturity approaches when bond issuers struggle with repayments, leading to negotiations for extensions.

Meanwhile, Cấn Văn Lực, chief economist at BIDV and Director of BIDV Training and Research Institute, said that while bankruptcy is already challenging for Vietnamese companies, it becomes even more complex for those with bond debts.

The unresolved issue is how to address these outstanding bond debts.

On the other hand, investors are also increasingly stressing the need for negotiation. The move is due to the prolonged court process for recovering bonds from insolvent firms, which is significantly longer than out-of-court negotiations in most markets.

Additionally, instituting bankruptcy procedures for debt recovery may only result in creditors receiving up to 40 per cent of the principal debt, as per VIS Rating data.

Novaland's luxury apartment projects in HCM City. The property developer has sought consensus with investors to settle the bond debt issue. — VNA/VNS Photo

Higher risk tolerance

Besides enhancing bankruptcy legislation, experts said that it is important for investors to be aware of their investment duties, comprehending the risks involved in their investment choices and being ready for potential financial losses.

The Lehman Brothers bankruptcy crisis (2008 - 2011) stands as a prime example.

During this period, numerous investors in Hong Kong (China) holding 'mini bonds' staged protests, attributing blame to the government for its perceived lack of accountability.

The crux of the matter lay in the government's authorisation of financial product sales with risks that were not fully understood even by the authorities.

Subsequently, state regulatory bodies (including those in Hong Kong) issued liability waivers during sales campaigns, outlining the financial product risks. Distributors were mandated to collaborate with investors and secure signed liability waivers.

This underscores that every financial product carries some level of risk, prompting investors to define their risk tolerance.

Quỳnh said that in practice, policies should align with each stage of development. Regulatory bodies must accurately assess development stages to establish suitable policies that reasonably safeguard retail investors' interests, rather than providing absolute protection.

In essence, bond defaults, specifically corporate bond defaults, are potential in all markets, necessitating investors to be prepared for such scenarios when selecting this investment channel.

Some banks are already compelled to create provisions due to problematic bond debts.

Therefore, enhancing investor knowledge is crucial to cultivating a sustainable corporate bond market. — VNS

Read original article here