The demand for industrial land for lease in Việt Nam remains high, but the supply of industrial land is low.

Given the shortage of land funds, some industrial real estate companies are expected to witness positive business results.

In the first quarter of 2023, the industrial park real estate market recorded a slow growth in the eligible land fund for rent, up 2.1 per cent over the end of 2022. The gain came from the addition of land for lease from industrial zones in Long An, Bắc Ninh, and Hải Dương Provinces.

Phan Văn Mai, Chairman of the HCM City People's Committee, said at a meeting in late April that the city also lacks industrial land for leasing to draw sizable projects and sizable investors for new companies.

The shortage of industrial land funds is happening Đồng Nai Province, limiting FDI capital. The province is no longer in the Top 5 localities attracting the most FDI inflows in the country, according to the report on foreign direct investment in 2022.

The occupancy rate, however, stayed at a high level in tier-1 markets, including Hà Nội, Hải Phong, Hải Dương, Hưng Yên, and Bắc Ninh Province in the north, and HCM City, Đồng Nai, Bình Dương and Long An Province in the southern region.

In particular, the industrial zones in the south have an average occupancy rate of 85 per cent, with the rate of Bình Dương's largest industrial parks up to 94 per cent.

The northern industrial zones have lower occupancy rates, averaging about 80.6 per cent, down about 2.2 percentage points over last year.

During the period, the average rental prices in the southern industrial park market saw a 4 per cent growth year-on-year to US$172.8 per square metre, helping the gross growth rate of the past five years to reach 9 per cent a year.

Meanwhile, rent for industrial land in the North was up only 2.2 per cent on-year to $122.9 per square metre in the tier-1 market's provinces.

Rents in Bắc Ninh and Hải Dương Provinces rose the most, up 3 - 5 per cent year-on-year, thanks to the new supplies with better rental prices than the general market, according to an industrial report from VietFirst Securities Corporation.

Still in demand

Vietnamese industrial parks are currently more appealing than those of rival countries in the area, largely because the local currency has depreciated less over the past year compared to those of Malaysia, Indonesia, and India.

Rent for industrial land in Việt Nam is currently 25-40 per cent lower than other countries in the region. In addition, the country possesses a strategic geographical position, which is close to key Asian supply chains.

Việt Nam is still expected to benefit the most from the trend of moving plants from China, especially for large manufacturers. LG Group plans to invest $4 billion in Việt Nam, while Samsung will raise investment capital to $20 billion.

However, FDI inflows show signs of decline due to concerns about economic recession and the continuous rate hikes from the US Federal Reserve, causing the rent for industrial land in Việt Nam to advance slightly this year.

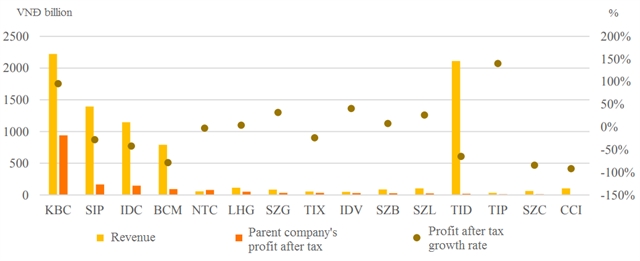

Business results of listed enterprises in industrial real estate in the first quarter of 2023. Graphic: VietFirst Securities

On the stock market, the securities firm said that in the first quarter of 2023, the total revenue of listed enterprises in industrial real estate climbed by 4.2 per cent over last year, but profit decreased by 8.6 per cent.

In the last quarter of 2022, the total revenue and total profit of these enterprises decreased by 18 per cent and 88.5 per cent on-year, respectively.

The recovery in business results was mainly led by Kinh Bắc Development Holding Corporation (KBC). The property developer's parent company posted a profit after tax of VNĐ940.7 billion ($40 billion), up 95.6 per cent year-on-year over the same period last year, accounting for 54.8 per cent of the total profit after tax of the whole industry in the first quarter.

Given the possible higher the rental prices for the industrial land and steady demand from the FDI sector, the business activities of industrial park real estate enterprises are expected to continue to recover in the near future.

VietFirst Securities also notes that enterprises owning land funds in key areas, especially the north, will have the opportunity to emerge and receive FDI inflows shifting out of China. — VNS

Read original article here